How AI Chatbot can transform Banking Industry?

- November 12, 2020

- Priyanka Shah

- Conversational AI, Engineering/ ML

When we talk about the adoption of new technologies in various industries, Banking is always on top! Particularly in conversational AI, banks have taken a lot of interest in recent years. A number of banks are implementing AI-powered conversational solutions. Usually, banks have a large customer base. Banking chatbot or Voice bots conduct smart conversations with millions of customers on behalf of banks. It is way more reliable and cost-effective than hiring customer service staff.

Basic task likes balance inquiry, account details, loan queries can easily be handled with chatbots. Your service representatives can spend their valuable time on complex issues. Conversational AI gives long-term benefits to banks in terms of efficiency and speed. A chatbot provides customers with instant access to service through conversational interfaces.

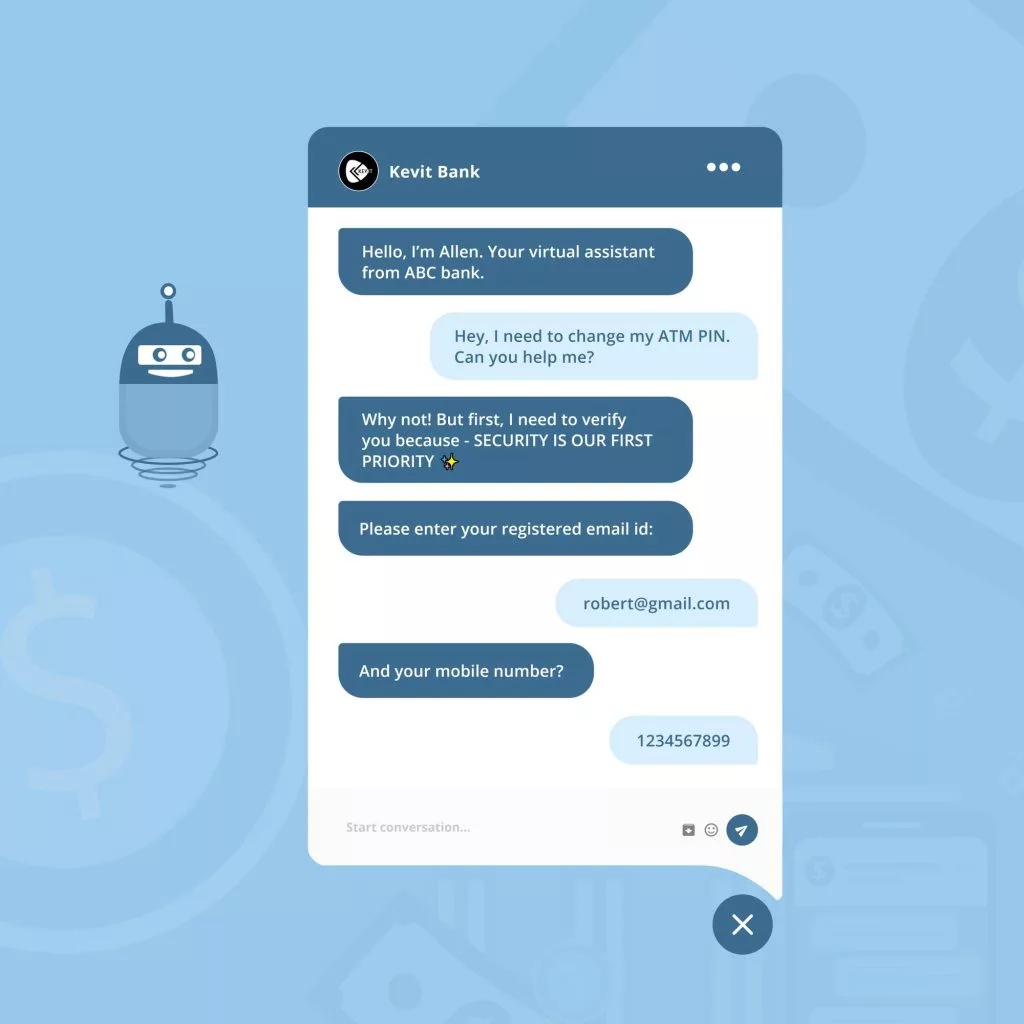

The best example of chatbot in banking is Erica. Erica is Bank of America’s virtual assistant chatbot. It takes Text as well as Voice commands and performs operations like showing the latest transaction list, scheduling payments, etc. Another good example of a banking bot is Capital One’s text bot. It allows customers to manage their money via text message, they can view payment history and also can pay a credit card bill. Mastercard has a bot on Facebook Messenger which has similar functionalities like others, and also provides updates on cardholder benefits & notifies users about offers. You can see the example below 👇

Benefits of Banking Chatbot:

These are the benefits of using banking chatbots:

1. Cost-Effective:

Bots are comparatively inexpensive to develop and maintain compared to the human service representative. One time investment in chatbots gives you long term services and benefits. Chatbots can be deployed in many channels where your customer has a daily presence like social media apps. Plus it doesn’t require expensive data storage.

2. Ease of use:

Chatbots are more automated and easier to use than traditional banking app and websites. There is no download required as it can be deployed in your already favorite messaging channels and apps. It gives your customers a personalized experience thanks to ML and NLP. Plus the conversation is the most easy interface too.

3. Personalized Interaction:

Nowadays customers are looking for a personalized yet faster solution for their problems and queries. That’s why AI chatbots become extremely important in banking. With chatbots and virtual assistants, banks can serve their customer’s effective services without spending huge amounts of time, resources & manpower.

4. Smart Adviser:

AI chatbots can analyze the customer’s data and can provide various advice according to that. It can track where customers are spending, how frequent they can spend, what are their budgets, etc. With all these information chatbots can provide financial advice individually. Banks can suggest various investments and plans according to these data.

5. Operation & Security:

Rich actionable messaging and operation handling makes the conversation of chatbot more – interactive, fruitful and easy to act upon. Data security is extremely important in banking operations because of the involvement of financial assets. The chatbot provides simple and secure interactions so your customers can feel comfortable while using your services.

6. 24/7 Support:

Banks receive a number of common queries in a day. Like asking for their current balance, loan-related documents, and queries, how to send money to and many more. Chatbot delivers ‘always-on’ customer service for these repetitive tasks. Your customer does not need to wait and hold on the line. They can access your services anytime anywhere. Chatbots are likely to attract and engage customers.

Features of Banking Chatbot:

These are the features of banking chatbots:

1. Request Cheque Book:

Customers can request a check book and also can request for renewal with just a few messages anytime, anywhere.

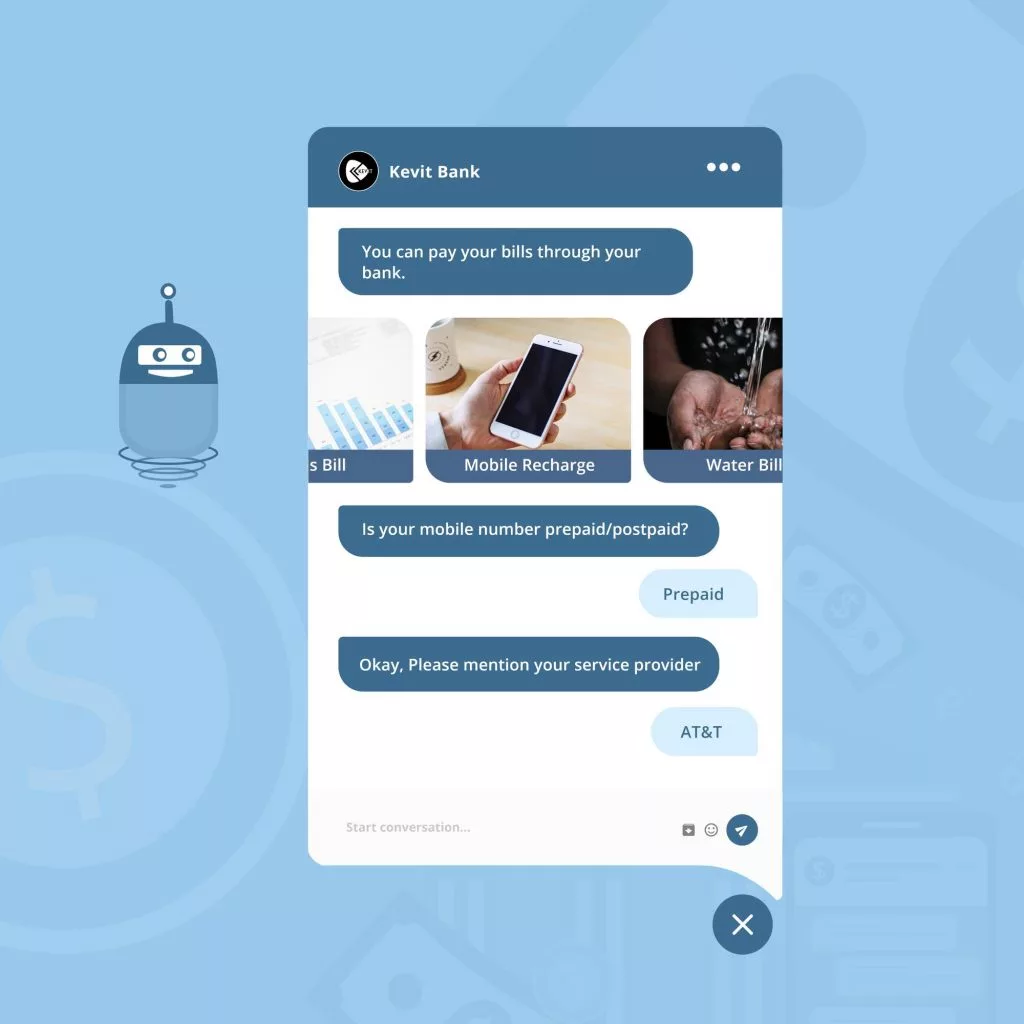

2. Bill Payment:

With chatbots, your customers can pay their bills securely.

3. ATM & Branch Locator:

Customers can locate the closest branches of the bank from the current location.

4. Money Transfer:

Chatbots gives you a quick and easy money transfer.

5. EMI & Loan Calculator:

Chatbots can keep track of loans and the next EMI with regular reminders.

6. Capture High-Quality Leads:

The chatbot can be programmed to ask various questions to gather lead data for your CRM and deliver the most qualified leads directly to your sales team.

7. Promotions and Sales Push:

Bank can send a notification for promotion and sales.

Chatbots are an excellent tool to interact and help your clients. In fact, chatbots have proven their importance in fraud detection, and data collection & analyzation. Reducing fraud is crucial for banks. It is not only the customer’s loss of money but also it’s a question of a bank’s reputation. If chatbots are well planned and implemented, they can be very helpful in this case also.

Now is the right time to get an intelligent banking chatbot for your own company and services with advanced AI technologies. At Kevit.io we believe in building intuitive bots that suit your requirements, to know more mail us at coffee@kevit.io and do visit us at Kevit.io.

See Kevit.io In Action

Automating business processes with Kevit.io is now just a click away!