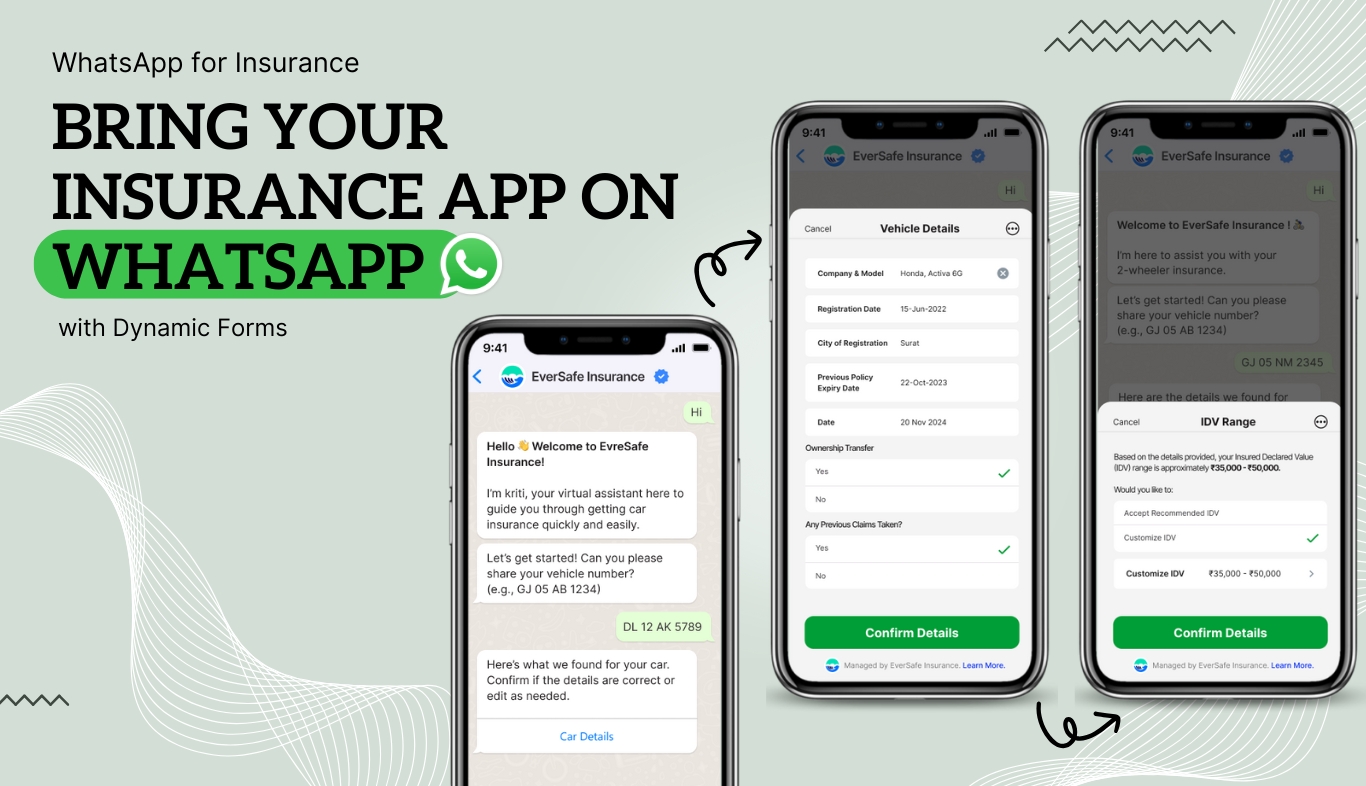

WhatsApp for Insurance: Bring your Insurance App on WhatsApp

- December 31, 2024

- Priyanka Shah

- WhatsApp Forms, WhatsApp Post

Transform your insurance service with WhatsApp for Insurance! This industry is undergoing a digital revolution, adopting tools like WhatsApp to address customer needs for seamless, efficient service. WhatsApp Business API’s latest release of dynamic forms, a step ahead of guided WhatsApp chatbots are streamlining core processes, from onboarding to claims and renewals. This guide explores specific use cases, showcasing how WhatsApp Dynamic Forms help insurers improve operations and boost customer satisfaction. Discover actionable strategies and real-world applications to unlock the full potential of WhatsApp in the insurance sector.

1. Understanding WhatsApp’s Role in the Insurance Industry

WhatsApp is more than a messaging app—it’s a tool transforming the insurance industry. Using WhatsApp for insurance services will be a game-changer. With over 2 billion users globally, it offers insurers a platform to:

- Simplify complex processes like policy renewals and claims.

- Enhance engagement through real-time interactions.

- Integrate seamlessly with existing systems, including dynamic forms for data collection.

The WhatsApp Business API and dynamic forms eliminate friction, ensuring a smooth, mobile-first customer experience.

2. Top Challenges Faced By Insurance Companies

The insurance industry operates in a highly competitive and regulation-driven environment. Insurers face several critical challenges that hinder operational efficiency and impact customer satisfaction:

- Cumbersome Processes

Traditional insurance processes—like purchasing policies, filing claims, and completing KYC—are often lengthy and resource-intensive. Dynamic forms on WhatsApp simplify these processes, reducing frustration and delays. - High Customer Drop-Off Rates

Customers frequently abandon their journeys due to unclear workflows or multiple platform transitions. By using WhatsApp Dynamic Forms, insurers can create intuitive, conversational workflows that retain customers. - Limited Self-Service Options

Customers increasingly expect autonomy in managing their insurance needs. However, many insurers lack accessible self-service options, forcing policy holders to rely on physical branches or call centers. - Resource Strain

The reliance on manual processes, physical infrastructure, and human agents increases operational costs. Insurers often struggle to scale efficiently to meet rising customer demands. - Regulatory and Security Challenges

Insurers handle sensitive customer data, requiring strict compliance with laws like GDPR. Balancing robust data security with seamless customer experiences remains a persistent challenge. - Disconnected Communication Channels

A lack of integration across platforms leads to repetitive data entry and fragmented customer support experiences. This misalignment frustrates customers and impacts retention rates. - Accessibility and Inclusivity Gaps

Without support for regional languages or accessibility features, a significant segment of potential customers is excluded. Insurers lose the opportunity to expand their reach to underserved demographics.

3. Why Using WhatsApp for Insurance Service is a Game-Changer for Insurers?

The WhatsApp Business API is a game-changing tool for insurance companies, allowing them to connect with customers on a platform they already know and trust. By leveraging WhatsApp for Insurance Services, insurers can harness its powerful features for addressing the industry’s most pressing challenges while unlocking exciting new opportunities:

- Automation and Scalability with Dynamic Forms

By integrating WhatsApp Dynamic Forms, insurers can automate repetitive tasks like claims processing, policy updates, and KYC verification. These forms allow insurers to handle high volumes of interactions efficiently. - Seamless Communication

WhatsApp provides insurers with a unified platform to interact with customers in real-time. Its familiar interface eliminates the learning curve, making it easy for users to engage with insurance services. - Automation and Scalability

By integrating chatbots, insurers can automate repetitive tasks like answering FAQs, policy updates, and claims tracking. This not only reduces dependency on human agents but also allows insurers to handle a high volume of interactions without compromising quality. - Personalized Interactions

Insurers can leverage WhatsApp to send tailor messages based on customer data. For example, reminders about upcoming policy renewals or tailored recommendations for new products can boost engagement and satisfaction. - Integration with Existing Systems

The API seamlessly connects with CRMs, policy management tools, and payment systems, ensuring smooth workflows and better customer experiences. - Enhanced Security

WhatsApp’s end-to-end encryption ensures secure data transmission, meeting regulatory requirements while safeguarding sensitive customer information. - 24/7 Availability

With a WhatsApp chatbot, insurers can offer round-the-clock support, ensuring customers get timely assistance, even outside of traditional business hours.

4. WhatsApp Dynamic Forms: Redefining Customer Interactions

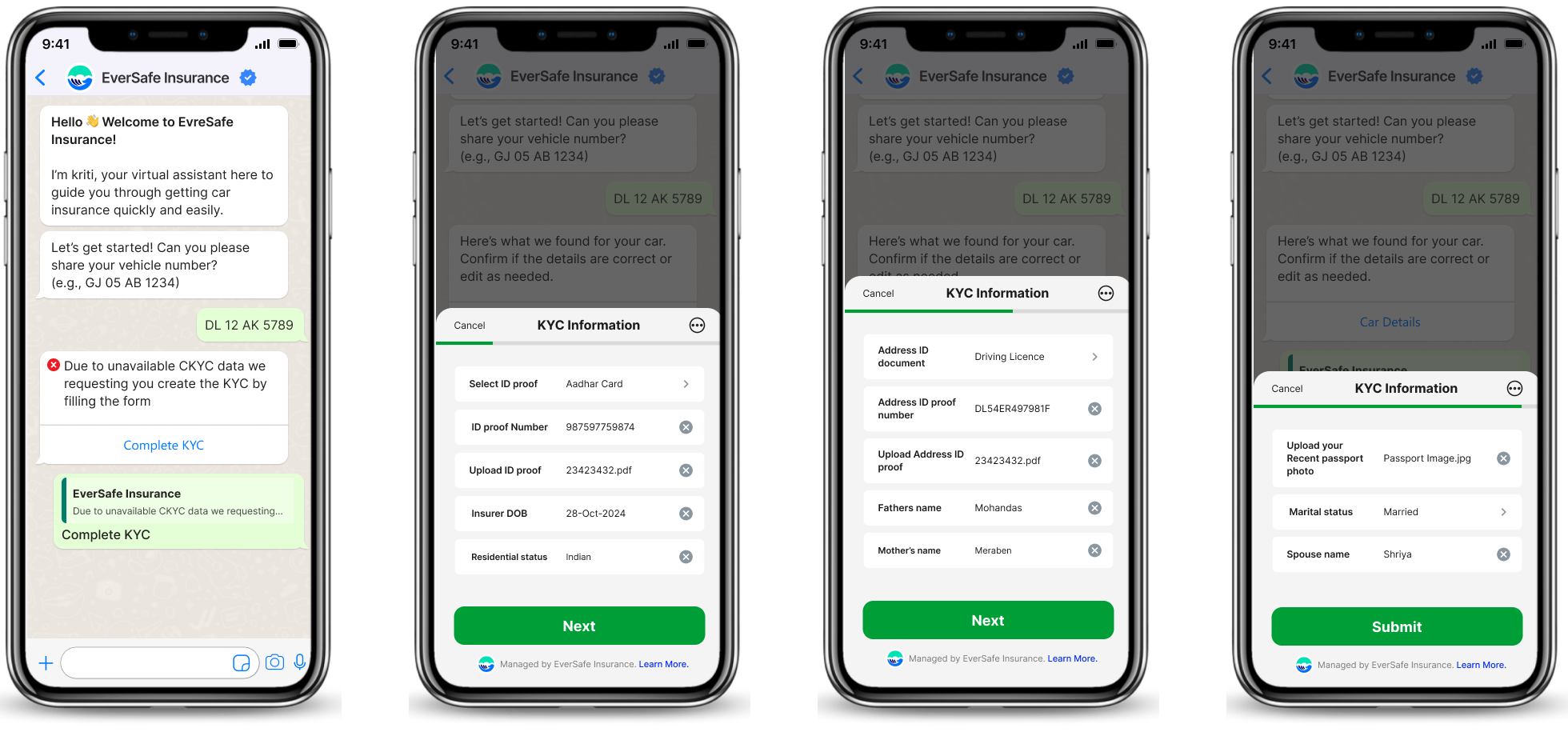

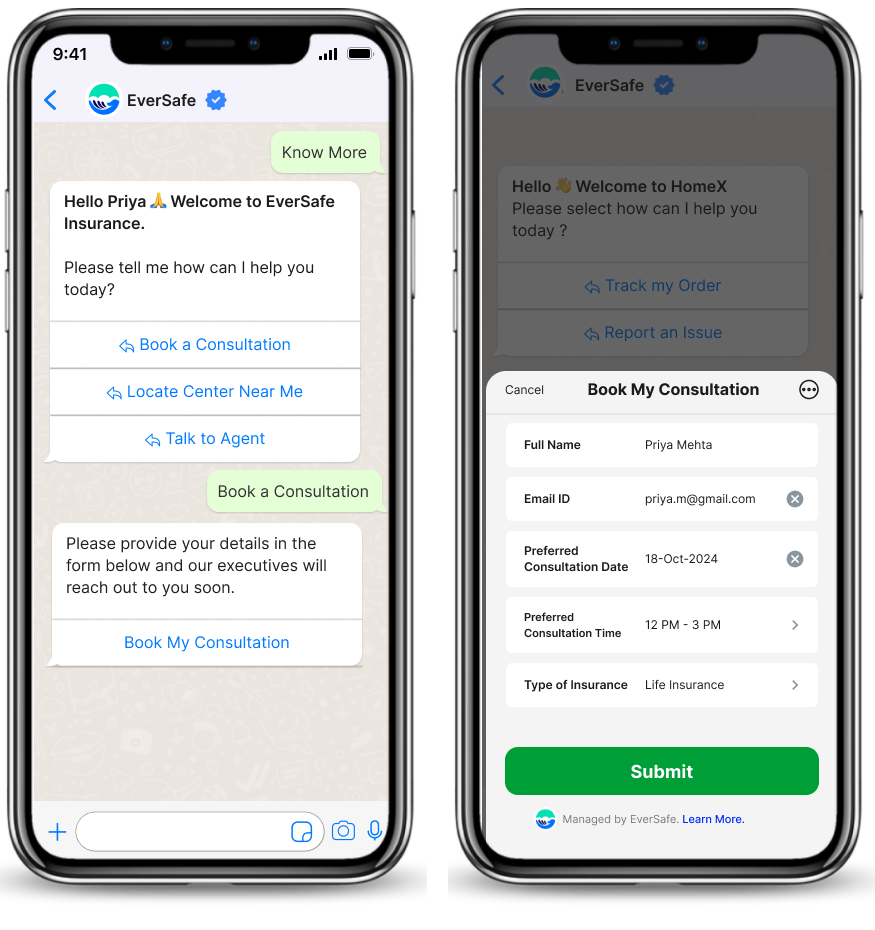

WhatsApp Dynamic Forms represent a significant leap in customer engagement for insurance companies. These interactive forms, as a step-by-step guide, integrated directly within WhatsApp chats, simplify insurance offerings, processes and create app-like experiences without requiring users to install additional applications.

- Simplified Customer Interactions

Dynamic forms guide customers step-by-step through tasks like filing claims, completing KYC, or applying for policies. The conversational format is intuitive and user-friendly, reducing friction and drop-offs. - Secure Data Collection

Customers can upload sensitive documents like IDs, address proofs, or claims-related images directly within WhatsApp using dynamic forms. End-to-end encryption ensures that all data is handled securely, meeting regulatory standards like GDPR. - Personalized Content Delivery

Dynamic forms adapt to customer inputs, providing tailored questions or next steps. For instance, a customer applying for car insurance might receive specific fields related to vehicle details, ensuring relevance and engagement. - Seamless Integration with Systems

These forms integrate with CRMs, policy management tools, and payment gateways. WhatsApp Dynamic Forms enable insurers to collect, process, and utilize data efficiently while maintaining a seamless workflow. - Real-Time Updates and Notifications

Customers receive instant feedback on dynamic form submissions, such as acknowledgment of claims or KYC completion. Automated notifications keep them informed about the progress, enhancing transparency and trust. - No App Installations Required

Unlike traditional processes that require customers to navigate complex websites or download separate apps, dynamic forms on WhatsApp work within a familiar messaging environment. This simplicity boosts engagement and completion rates.

5. Use Cases of WhatsApp for Insurance services

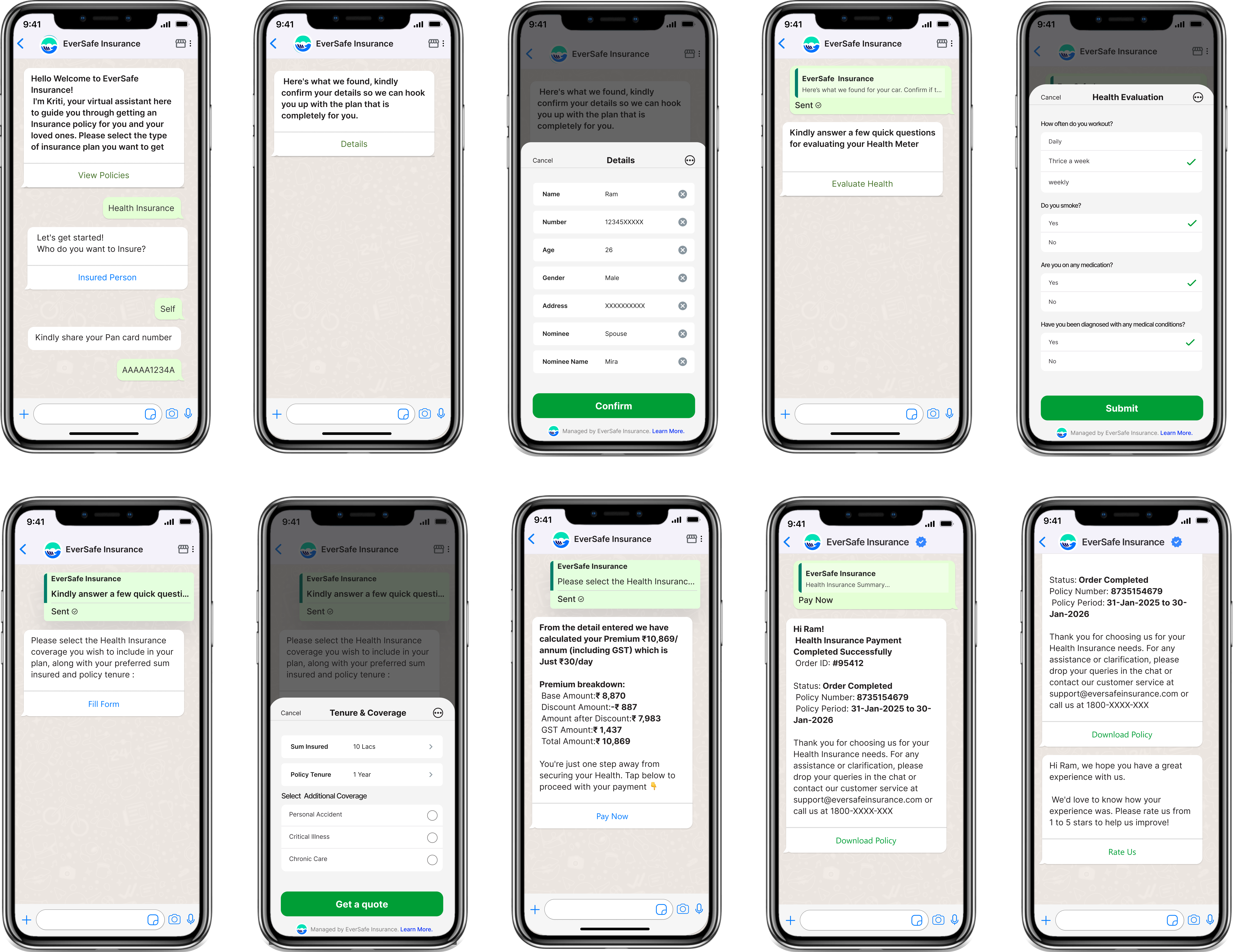

End-to-End Policy Purchase

- Customers complete guided questionnaires via WhatsApp Dynamic Forms to determine eligibility.

- They receive tailored policy suggestions based on their responses.

- Transactions are completed with secure, in-chat payment options.

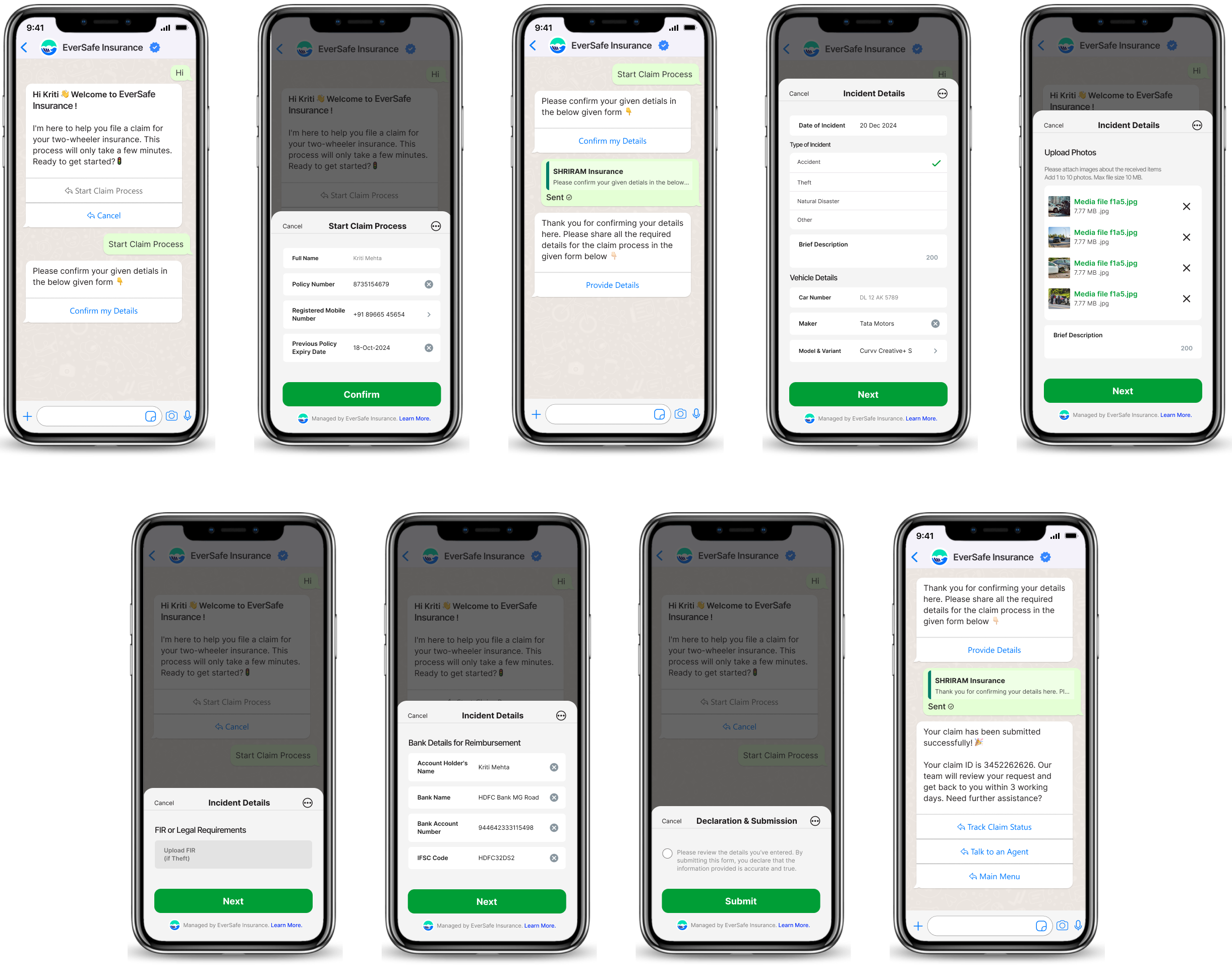

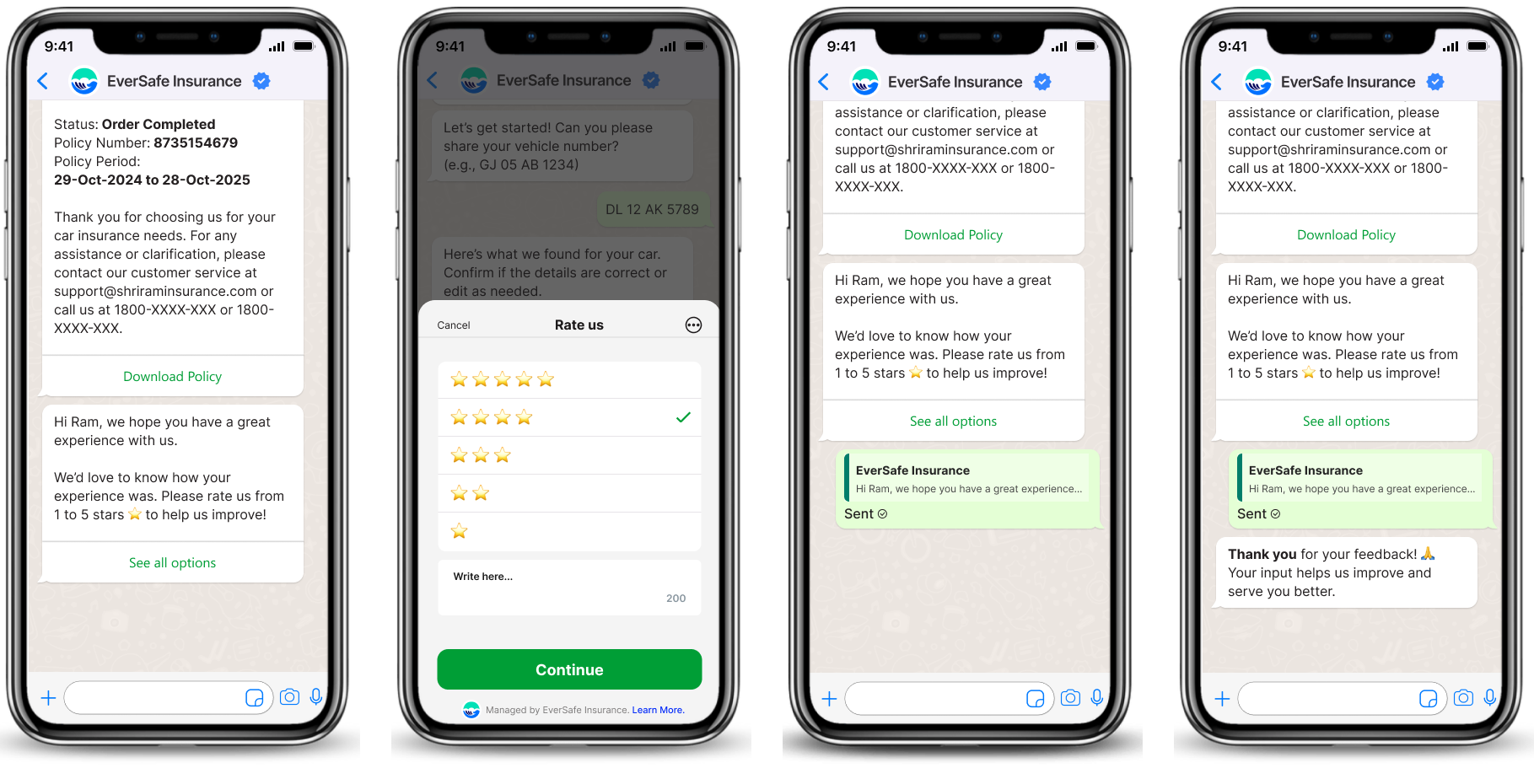

Simplified Claims Experience

- Customers use dynamic forms to upload necessary documents and provide claim details.

- Automated validation ensures all required information is captured.

- Notifications and real-time updates keep customers informed about claim status.

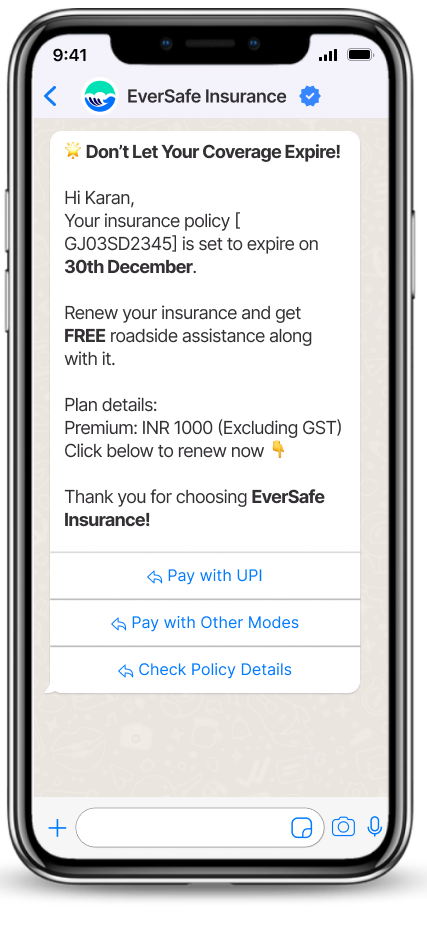

Streamlined Policy Renewals

- Dynamic forms simplify the renewal process by collecting updated customer information and facilitating payments.

- Automated reminders and payment confirmations enhance the experience.

Seamless eKYC Verification

- Customers submit and verify required documents securely using WhatsApp Dynamic Forms, expediting the onboarding process.

Lead Management Optimization

- Prospects are directed to dynamic forms through click-to-WhatsApp ads, capturing data for personalized follow-ups.

Automated Feedback Collection

- Dynamic forms enable insurers to conduct surveys efficiently, gathering actionable insights from customers.

Conclusion

WhatsApp Dynamic Forms are a cornerstone of digital transformation in the insurance industry. They streamline complex processes, provide personalized interactions, and deliver app-free convenience to customers. By integrating these forms into the WhatsApp Business API, insurers can revolutionize how they interact with policyholders, improve operational efficiency, and achieve greater customer satisfaction.

In today’s mobile-first world, embracing WhatsApp Dynamic Forms is not just an innovation—it’s a necessity for staying competitive

See Kevit.io In Action

Automating business processes with Kevit.io is now just a click away!