Insurance Chatbot: Transform Insurance Industry With AI bots

- November 19, 2021

- Priyanka Shah

- Insurance

Insurance can be termed as an important and serious subject which can get complex at times. Insurance Industry demands numerous investments from the customer’s part, not all transactional but attention and time too. It’s always associated with never-ending legal processes, claim settlement, and hefty paperwork. This industry is seen to be deemed with the least amount of innovative automatic features, and one of the effective ways to change it could be instilling Conversational AI chatbots in Insurance.

This is where Conversational AI comes in use.

What is an Insurance Chatbot?

THE PROBLEM

Unlike Ecommerce and Travel, Insurance is not a “prettiest one wins” type of purchase. One cannot win customers by having the prettiest website or only attractive offers. But win them over with top notch personalized customer experience, proper services and communication, budget-friendly premiums and 24*7 query resolving.

But the problem that the insurance companies face is to achieve these goals all together to increase their ratio of retaining customers. However, what puts limitations to achieve this is the lack of technology and awareness of the existing ones.

You know your company’s a hit when you can cognize claims- anytime and anywhere. But using SMS, Emails and phone calls will not help as their fill-through rates and conversations rates are way too low, almost static.

So, what can insurance companies do to fight these loopholes or is there a better solution than the existing one?

THE SOLUTION

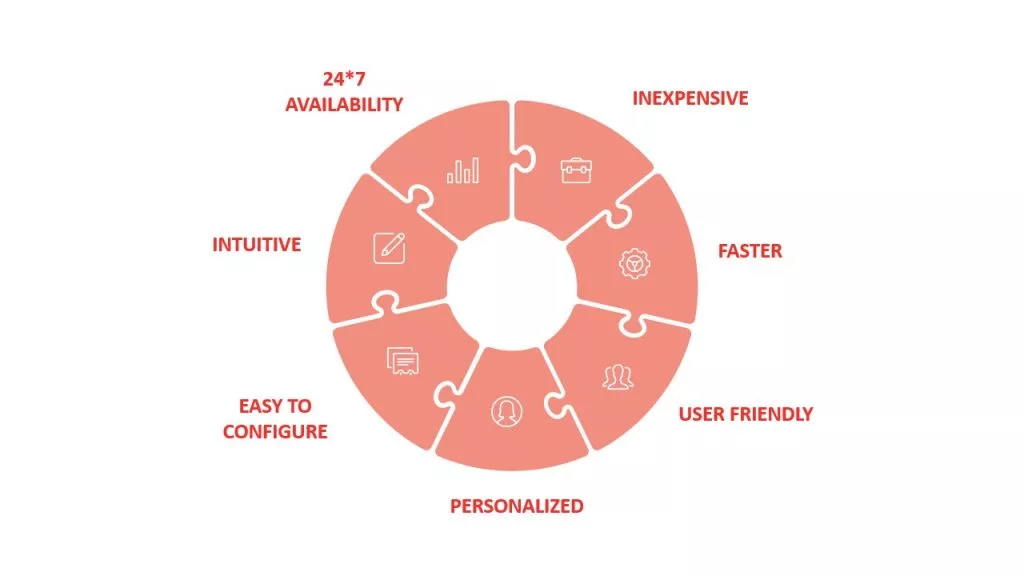

Insurance companies need is a tool that’s-

Benefits of Insurance Chatbot:

1. Customer Awareness & Education

Insurance bots can make customers aware of the working of different investment schemes and suggest optimal policies according to the user’s data input and search entries.

- Interaction with each visitor

- Personalized Suggestions

2. Rich Database

Chatbots are designed to take input from users regarding personal information. This information is then stored, analysed, and later added to the user database for emails, newsletters, social media updates, etc.

- Secured storage of data

- Analysed for personalized solutions

3. Reduced Workload

Not only for legacy procedures but chatbots also help decrease considerable workload for your sales and marketing teams.

- Repetitive queries resolved

- Now focus on the conversion of leads into sales

4. Fraud Detection and Prevention

It takes utmost security to safeguard people’s private data and chatbots are ready to contribute the same. Conversational AI empowered insurance chatbots provide a safe and secure environment to communicate and share all sensitive information.We can add multiple protection layers to strengthen the security of Conversational AI bots.

Read Conversational AI Chatbots Are Smart But Safe Too?? Article to know more about Conversational AI bots and its security protocols.

- AI Generation security

- Enhances loyalty by gaining user’s trust

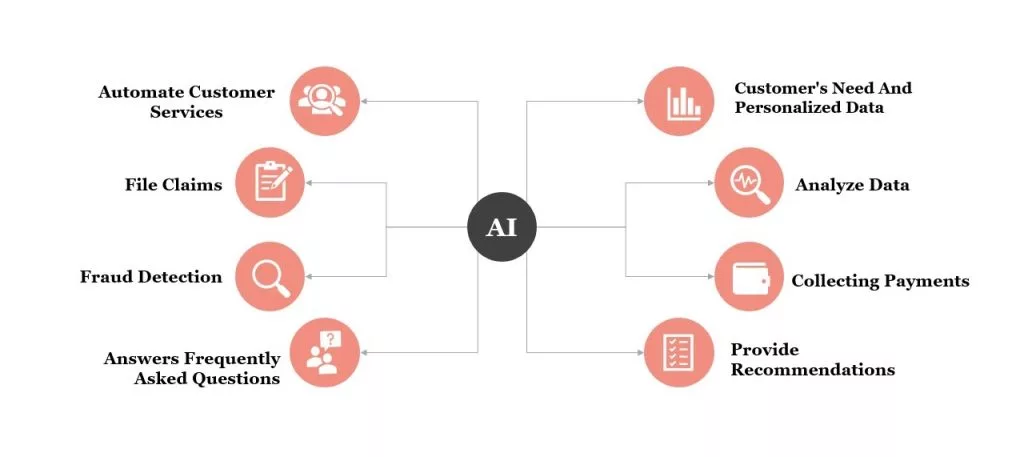

How can companies use Chatbots for Insurance?

How does an AI-Powered Chatbots increase insurance provider conversion rate?

How Chatbot for Insurance Sector help Customers?

Insurance Chatbots: Better Future For The Insurance Industry

Conversational AI bots are known for making tasks as easy as possible so that people don’t consider them a burden. And they try to enable the same for the Insurance industry too.

Your company is leaving out serious money on the table if you’re still doubting the functionalities of these insurance chatbots. With no doubt, Kevit can claim that Conversational AI will be a smooth ride for your customers and your firm, making all complex insurance processes simpler and smoother. Kevit is ready with insurance chatbots to help you provide a seamless experience to your customers. Know more about Kevit at Kevit.io and mail us at coffee@kevit.io.

See Kevit.io In Action

Automating business processes with Kevit.io is now just a click away!